Latest News

Questions to Ask Before Hiring an Injury Lawyer | A Quick Checklist

Use this quick checklist to choose an injury lawyer, compare fees, experience, and strategy, and protect your personal injury claim from costly errors.

Via Visibility · January 29, 2026

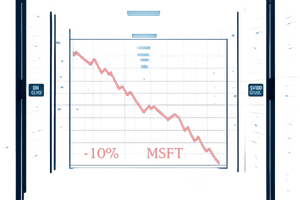

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

MENLO PARK, CA — In a resounding validation of its aggressive pivot toward artificial intelligence, Meta Platforms (NASDAQ:META) saw its stock price skyrocket by 9% in late January 2026. The surge followed a blowout fourth-quarter earnings report that silenced critics of the company’s massive capital expenditure and established the

Via MarketMinute · January 30, 2026

Trump Reportedly Picks Insider To Head Bureau Of Labor Statisticsstocktwits.com

Via Stocktwits · January 30, 2026

Apple Inc. (NASDAQ: AAPL) delivered a commanding performance in its fiscal first-quarter earnings report on January 29, 2026, shattering revenue and profit records on the back of explosive demand for the iPhone 17. Despite exceeding analyst expectations across nearly every major metric, the tech giant saw its stock price decline

Via MarketMinute · January 30, 2026

The financial markets were jolted on January 30, 2026, as the Bureau of Labor Statistics (BLS) released Producer Price Index (PPI) data for December 2025 that was significantly "warmer" than any analyst had predicted. Headline PPI rose 0.5% month-over-month, more than double the consensus estimate of 0.2%, while

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

NextEra Energy combines utility stock stability with renewable energy upside.

Via The Motley Fool · January 30, 2026

Webull Corporation delivers digital trading and wealth management tools for retail investors in the online brokerage sector.

Via The Motley Fool · January 30, 2026

The memory shortage got a lot of attention on Apple's earnings call.

Via The Motley Fool · January 30, 2026

A recently completed merger sets the stage for increased profitability.

Via The Motley Fool · January 30, 2026

It may seem like a negative change, but there's a huge silver lining.

Via The Motley Fool · January 30, 2026

Stock Yards Bancorp delivers commercial banking and wealth management services across key Midwest metropolitan markets.

Via The Motley Fool · January 30, 2026

Nvidia's stock still has a lot of potential upside.

Via The Motley Fool · January 30, 2026

Altria is an excellent income play for long-term investors.

Via The Motley Fool · January 30, 2026

Musk weighs empire-wide mergers as dealmaking heats up across tech, sports, retail, AI, private equity, and bankruptcy restructurings.

Via Benzinga · January 30, 2026

OpenAI and Anthropic are expected to have IPOs in 2026, potentially driving up AI infrastructure spending and benefiting companies like Nvidia, Amazon, and Microsoft.

Via Benzinga · January 30, 2026

The choice between the two might come down to each investor's goals and risk tolerance.

Via The Motley Fool · January 30, 2026

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

OnlyFans a deal that would value the company at $5.5 billion when factoring in its existing debt — and a potential IPO.

Via Benzinga · January 30, 2026

FanDuel's parent company Flutter and DrafKings dropped 2% and 8%, respectively, after the news.

Via Investor's Business Daily · January 30, 2026

The cryptocurrency market has experienced pronounced selling over the last year.

Via The Motley Fool · January 30, 2026

President Trump nominates Kevin Warsh as next Chair of Federal Reserve, signaling a less aggressive policy and reversing market trends.

Via Benzinga · January 30, 2026

Intuit is still guiding for double-digit growth in fiscal 2026, but at a meaningfully slower rate than last year.

Via The Motley Fool · January 30, 2026