WHEAT RIDGE, CO / ACCESS Newswire / May 15, 2025 / Lifeloc Technologies, Inc. (OTC:LCTC), a global leader in the development and manufacturing of breath alcohol and drug testing devices, has announced financial results for the first quarter ended March 31, 2025.

First Quarter Financial Highlights

Lifeloc posted quarterly net revenue of $2.277 million resulting in a quarterly net loss of $(293) thousand, or $(0.11) per diluted share. These results compare to net revenue of $2.153 million and quarterly net loss of ($284) thousand, or ($0.12) per diluted share in the first quarter of 2024. Revenue grew by $124 thousand or 6% versus the first quarter last year. Gross margin in the first quarter improved to 39.9% versus 38.8% last year, due primarily to increased pricing and better volumes. Research and Development investment remains high at more than 20% of revenue, primarily for SpinDx development, contributing significantly to the current period loss.

We believe our core alcohol detection product line-up is strong. The L-series LX9 and LT7 units have features and performance that are driving market penetration by meeting previously unaddressable market needs, such as smart phone pairing, wider temperature use ranges and fast customization that incorporates local languages. Sales of our newer L-series devices are mostly incremental to our installed base of FC-series devices rather than displacing FC sales. The L-series devices have been certified to meet the requirements of most modern registration standards, such as SAI's (Standards Australia International) latest AS 3547:2019 standards for Breath Alcohol Detectors. We continue to evolve the capability and certifications of these units to add more value and gain market share. Our FC-series devices remain popular with many law enforcement and international organizations. Our Easycal® automated calibration station, the only automated calibration available for portable breath alcohol testers, builds valuable protection around our brand and contributes to market share gains across the board, especially for our workplace Phoenix® 6.0 BT and EV 30 devices.

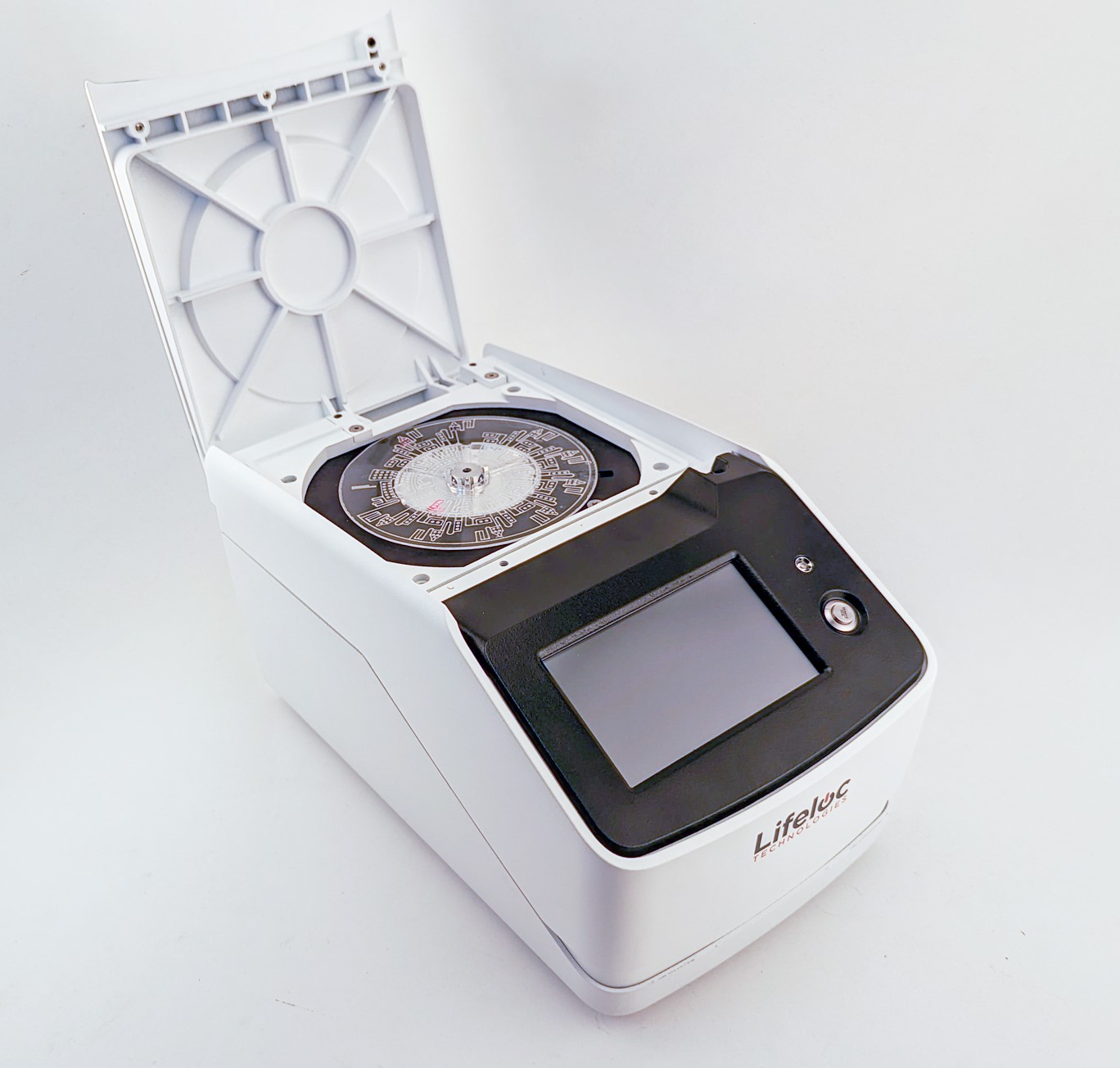

We believe our most important goal and best opportunity remains the convergence of the global need for rapid detection of drugs of abuse with Lifeloc's proven capability to build easy-to-use portable testing equipment. We are therefore focusing our research and development efforts on leveraging the SpinDx™ technology platform, sometimes referred to as "Lab on a Disk," to develop a series of devices and tests that can be used at roadside and in emergency rooms, forensic labs and workplace test sites to achieve a rapid and quantitative measure for a panel of drugs of abuse. Our SpinDx product enables rapid, on-site, and cost-effective drug testing using a centrifugal disk platform capable of detecting trace levels of drugs from small samples. Despite initial delays due to the pandemic, we have advanced the technology and filed our first utility patent application in 2024 for improvements to the system. SpinDx™ offers a unique advantage over competitors by isolating psychoactive delta-9-THC from its inactive metabolites, enabling more accurate impairment detection-especially critical for marijuana testing where competitive devices may yield false positives from non-impairing compounds. Beta testing with human subjects is set to begin in partnership with Anschutz Medical Center in Colorado, with commercial launch expected in 2026. We plan to launch the product in stages, beginning with a saliva-based system, followed by blood and breath sample capabilities, using our LX9 breathalyzer to produce a roadside marijuana breathalyzer system.

"Rapid drug testing is our biggest growth opportunity, and we believe that SpinDx will play an important role in addressing this unmet market need," commented Dr. Wayne Willkomm, President and CEO. "We have chosen to prioritize long term value creation over short term profitability to fund this opportunity. We anticipate continued high research and development expenses in this final push toward commercialization and are excited to begin to show our customers this developmental model."

Additionally, in alignment with the evolving structure of the OTC Markets, Lifeloc has completed its application for the OTCID, which will be the new market tier of the OTC Markets, effective July 1, 2025. OTCID is the replacement for fully reporting companies from the OTC Pink Current Market, which will cease July 1, 2025. We believe the new OTCID standards will create greater market confidence than the OTC Pink and allow a more liquid marketplace for our shareholders.

About Lifeloc Technologies

Lifeloc Technologies, Inc. (OTC:LCTC) is a trusted U.S. manufacturer of evidential breath alcohol testers and related training and supplies for Workplace, Law Enforcement, Corrections and International customers. Lifeloc stock trades over-the-counter under the symbol LCTC. We are a fully reporting Company with our SEC filings available on our web site, www.lifeloc.com/investor.

Forward Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involve substantial risks and uncertainties that may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements expressed or implied in this press release, including statements about our strategies, expectations about new and existing products, market demand, acceptance of new and existing products, technologies and opportunities, market size and growth, and return on investments in products and market, are based on information available to us on the date of this document, and we assume no obligation to update such forward-looking statements. Investors are strongly encouraged to review the section titled "Risk Factors" in our SEC filings.

Easycal® and Phoenix® are registered trademarks of Lifeloc Technologies, Inc.

SpinDx™ is a trademark of Sandia Corporation.

Amy Evans

Lifeloc Technologies, Inc.

http://www.lifeloc.com

(303) 431-9500

LIFELOC TECHNOLOGIES, INC. |

|

||||||||

Condensed Balance Sheets (Unaudited) |

|

||||||||

|

|

|

|

||||||

ASSETS |

|

||||||||

|

|

|

|

||||||

CURRENT ASSETS: |

|

March 31, 2025 |

|

|

December 31, 2024 |

|

|

||

Cash and cash equivalents |

|

$ |

1,522,457 |

|

|

$ |

1,243,746 |

|

|

Accounts receivable, net |

|

|

761,697 |

|

|

|

732,541 |

|

|

Inventories, net |

|

|

2,941,549 |

|

|

|

2,996,397 |

|

|

Federal and state income taxes receivable |

|

|

80,710 |

|

|

|

80,560 |

|

|

Prepaid expenses and other |

|

|

369,688 |

|

|

|

40,045 |

|

|

Total current assets |

|

|

5,676,101 |

|

|

|

5,093,289 |

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY, PLANT AND EQUIPMENT: |

|

|

|

|

|

|

|

|

|

Land |

|

|

317,932 |

|

|

|

317,932 |

|

|

Building |

|

|

1,928,795 |

|

|

|

1,928,795 |

|

|

Real-time Alcohol Detection And Recognition equipment and software |

|

|

569,448 |

|

|

|

569,448 |

|

|

Production equipment, software and space modifications |

|

|

1,349,839 |

|

|

|

1,349,839 |

|

|

Training courses |

|

|

432,375 |

|

|

|

432,375 |

|

|

Office equipment, software and space modifications |

|

|

254,333 |

|

|

|

254,333 |

|

|

Sales and marketing equipment and space modifications |

|

|

226,356 |

|

|

|

226,356 |

|

|

Research and development equipment, software and space modifications |

|

|

805,012 |

|

|

|

787,664 |

|

|

Research and development equipment, software and space modifications not in service |

|

|

129,207 |

|

|

|

128,007 |

|

|

Less accumulated depreciation |

|

|

(3,719,290 |

) |

|

|

(3,613,452 |

) |

|

Total property and equipment, net |

|

|

2,294,007 |

|

|

|

2,381,297 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS: |

|

|

|

|

|

|

|

|

|

Patents, net |

|

|

76,818 |

|

|

|

78,723 |

|

|

Deposits and other |

|

|

12,823 |

|

|

|

12,261 |

|

|

Deferred income taxes |

|

|

1,159,199 |

|

|

|

1,159,199 |

|

|

Total other assets |

|

|

1,248,840 |

|

|

|

1,250,183 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

9,218,948 |

|

|

$ |

8,724,769 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

||||||||

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

594,252 |

|

|

$ |

251,627 |

|

|

Term loan payable, current portion |

|

|

53,604 |

|

|

|

53,195 |

|

|

Subordinated debentures payable, current portion |

|

|

7,933 |

|

|

|

- |

|

|

Customer and tenant deposits |

|

|

124,209 |

|

|

|

43,814 |

|

|

Accrued expenses |

|

|

244,634 |

|

|

|

293,981 |

|

|

Deferred revenue, current portion |

|

|

62,437 |

|

|

|

54,458 |

|

|

Product warranty reserve |

|

|

46,500 |

|

|

|

46,500 |

|

|

Total current liabilities |

|

|

1,133,569 |

|

|

|

743,575 |

|

|

|

|

|

|

|

|

|

|

|

|

TERM LOAN PAYABLE, net of current portion and |

|

|

|

|

|

|

|

|

|

debt issuance costs |

|

|

1,099,722 |

|

|

|

1,119,152 |

|

|

|

|

|

|

|

|

|

|

|

|

SUBORDINATED DEBENTURES PAYABLE, net of |

|

|

|

|

|

|

|

|

|

debt issuance costs |

|

|

690,238 |

|

|

|

630,000 |

|

|

|

|

|

|

|

|

|

|

|

|

DEFERRED REVENUE, net of current portion |

|

|

13,928 |

|

|

|

6,165 |

|

|

Total liabilities |

|

|

2,937,457 |

|

|

|

2,498,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES (Note 6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Common stock, no par value; 50,000,000 shares authorized, 2,752,616 |

|

|

|

|

|

|

|

|

|

shares outstanding (2,664,116 outstanding at December 31, 2024) |

|

|

5,934,314 |

|

|

|

5,586,014 |

|

|

Retained earnings |

|

|

347,177 |

|

|

|

639,863 |

|

|

Total stockholders' equity |

|

|

6,281,491 |

|

|

|

6,225,877 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

9,218,948 |

|

|

$ |

8,724,769 |

|

|

LIFELOC TECHNOLOGIES, INC. |

|

||||||||

Condensed Statements of (Loss) (Unaudited) |

|

||||||||

|

|

|

|

|

|||||

|

Three Months Ended March 31, |

|

|

||||||

REVENUES: |

|

2025 |

|

|

2024 |

|

|

||

Product sales |

|

$ |

2,263,047 |

|

|

$ |

2,134,434 |

|

|

Royalties |

|

|

5,671 |

|

|

|

10,936 |

|

|

Rental income |

|

|

8,316 |

|

|

|

8,073 |

|

|

Total |

|

|

2,277,034 |

|

|

|

2,153,443 |

|

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES |

|

|

1,368,468 |

|

|

|

1,318,136 |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

|

908,566 |

|

|

|

835,307 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

Research, development, and sustaining engineering |

|

|

469,680 |

|

|

|

555,599 |

|

|

Sales and marketing |

|

|

334,556 |

|

|

|

345,009 |

|

|

General and administrative |

|

|

384,878 |

|

|

|

314,926 |

|

|

Total |

|

|

1,189,114 |

|

|

|

1,215,534 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING (LOSS) |

|

|

(280,548 |

) |

|

|

(380,227 |

) |

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

12,357 |

|

|

|

17,672 |

|

|

Interest expense |

|

|

(24,495 |

) |

|

|

(10,150 |

) |

|

Total |

|

|

(12,138 |

) |

|

|

7,522 |

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) BEFORE PROVISION FOR TAXES |

|

|

(292,686 |

) |

|

|

(372,705 |

) |

|

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM FEDERAL AND STATE INCOME TAXES |

|

|

- |

|

|

|

88,899 |

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) |

|

$ |

(292,686 |

) |

|

$ |

(283,806 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) PER SHARE, BASIC |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) PER SHARE, DILUTED |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, BASIC |

|

|

2,694,599 |

|

|

|

2,454,116 |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, DILUTED |

|

|

2,694,599 |

|

|

|

2,454,116 |

|

|

LIFELOC TECHNOLOGIES, INC. | ||||||||||||||||||||||||||||||||

Condensed Statements of Changes in Stockholders' Equity (Unaudited) | ||||||||||||||||||||||||||||||||

For The Three Months Ended March 31, 2025 and 2024 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

2025 |

|

|

2024 |

|

|||||||||||||||||||||||||||

|

Common Stock Shares |

|

|

Common Stock Amount |

|

|

Retained Earnings |

|

|

Total |

|

|

Common Stock Shares |

|

|

Common Stock Amount |

|

|

Retained Earnings |

|

|

Total |

|

|||||||||

Beginning balance |

|

|

2,664,116 |

|

|

$ |

5,586,014 |

|

|

$ |

639,863 |

|

|

$ |

6,225,877 |

|

|

|

2,454,116 |

|

|

$ |

4,668,014 |

|

|

$ |

1,692,811 |

|

|

$ |

6,360,825 |

|

Warrants issued with subordinated debenture |

|

|

- |

|

|

|

12,000 |

|

|

|

- |

|

|

|

12,000 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Issuance of shares from option exercise |

|

|

88,500 |

|

|

|

336,300 |

|

|

|

- |

|

|

|

336,300 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Net (loss) |

|

|

- |

|

|

|

- |

|

|

|

(292,686 |

) |

|

|

(292,686 |

) |

|

|

- |

|

|

|

- |

|

|

|

(283,806 |

) |

|

|

(283,806 |

) |

Ending balance |

|

|

2,752,616 |

|

|

$ |

5,934,314 |

|

|

$ |

347,177 |

|

|

$ |

6,281,491 |

|

|

|

2,454,116 |

|

|

$ |

4,668,014 |

|

|

$ |

1,409,005 |

|

|

$ |

6,077,019 |

|

LIFELOC TECHNOLOGIES, INC. | ||||||||||

Condensed Statements of Cash Flows (Unaudited) | ||||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

Three Months Ended March 31, |

|

|

|||||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

2025 |

|

|

2024 |

|

|

|||

Net (loss) |

|

$ |

(292,686 |

) |

|

$ |

(283,806 |

) |

|

|

Adjustments to reconcile net (loss) to net cash |

|

|

|

|

|

|

|

|

|

|

(used in) operating activities- |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

107,577 |

|

|

|

51,085 |

|

|

|

Provision for inventory obsolescence, net change |

|

|

- |

|

|

|

17,500 |

|

|

|

Deferred taxes, net change |

|

|

- |

|

|

|

(88,899 |

) |

|

|

Changes in operating assets and liabilities- |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(29,156 |

) |

|

|

55,219 |

|

|

|

Inventories |

|

|

54,848 |

|

|

|

(10,171 |

) |

|

|

Federal and state income taxes receivable |

|

|

(150 |

) |

|

|

- |

|

|

|

Prepaid expenses and other |

|

|

(329,643 |

) |

|

|

(160,989 |

) |

|

|

Deposits and other |

|

|

(562 |

) |

|

|

(154,012 |

) |

|

|

Accounts payable |

|

|

342,625 |

|

|

|

153,929 |

|

|

|

Income taxes payable |

|

|

- |

|

|

|

(44,952 |

) |

|

|

Customer and tenant deposits |

|

|

80,395 |

|

|

|

(17,667 |

) |

|

|

Accrued expenses |

|

|

(49,347 |

) |

|

|

(153,395 |

) |

|

|

Deferred revenue |

|

|

15,742 |

|

|

|

(5,498 |

) |

|

|

Net cash (used in) operating |

|

|

|

|

|

|

|

|

|

|

activities |

|

|

(100,357 |

) |

|

|

(641,656 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS (USED IN) INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Purchases of office equipment, software and space modifications |

|

|

- |

|

|

|

(16,572 |

) |

|

|

Purchases of research and development equipment, software and |

|

|

|

|

|

|

|

|

|

|

space modifications |

|

|

(17,348 |

) |

|

|

(41,858 |

) |

|

|

Purchases of research and development equipment, software and |

|

|

|

|

|

|

|

|

|

|

space modifications not in service |

|

|

(1,200 |

) |

|

|

- |

|

|

|

Patent filing expense |

|

|

- |

|

|

|

(21,708 |

) |

|

|

Net cash (used in) investing activities |

|

|

(18,548 |

) |

|

|

(80,138 |

) |

|

|

|

|

|

|

|

|

|

|

|

||

CASH FLOWS FROM (USED IN) FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Principal payments made on term loan |

|

|

(13,684 |

) |

|

|

(13,287 |

) |

|

|

Proceeds from issuance of subordinated debenture |

|

|

75,000 |

|

|

|

- |

|

|

|

Issuance of shares from option exercise |

|

|

336,300 |

|

|

|

- |

|

|

|

Net cash provided from (used in) financing |

|

|

|

|

|

|

|

|

|

|

activities |

|

|

397,616 |

|

|

|

(13,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

||

NET INCREASE (DECREASE) IN CASH |

|

|

278,711 |

|

|

|

(735,081 |

) |

|

|

|

|

|

|

|

|

|

|

|

||

CASH, BEGINNING OF PERIOD |

|

|

1,243,746 |

|

|

|

1,766,621 |

|

|

|

|

|

|

|

|

|

|

|

|

||

CASH, END OF PERIOD |

|

$ |

1,522,457 |

|

|

$ |

1,031,540 |

|

|

|

|

|

|

|

|

|

|

|

|

||

SUPPLEMENTAL INFORMATION: |

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

19,324 |

|

|

$ |

9,073 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Cash paid for income tax |

|

$ |

150 |

|

|

$ |

6,440 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Non-cash financing and investing activities: warrants issued with |

|

|

|

|

|

|

|

|

|

|

subordinated debenture |

|

$ |

12,000 |

|

|

$ |

- |

|

|

|

SOURCE: Lifeloc Technologies, Inc.

View the original press release on ACCESS Newswire