Golden, Colorado-based Molson Coors Beverage Company (TAP) manufactures, markets, and sells beer and other malt beverage products under various brands. Valued at $9.3 billion by market cap, TAP produces many beloved and iconic beer brands, including Coors Light, Miller Lite, Madri, Staropramen, Miller High Life, and Keystone, among others.

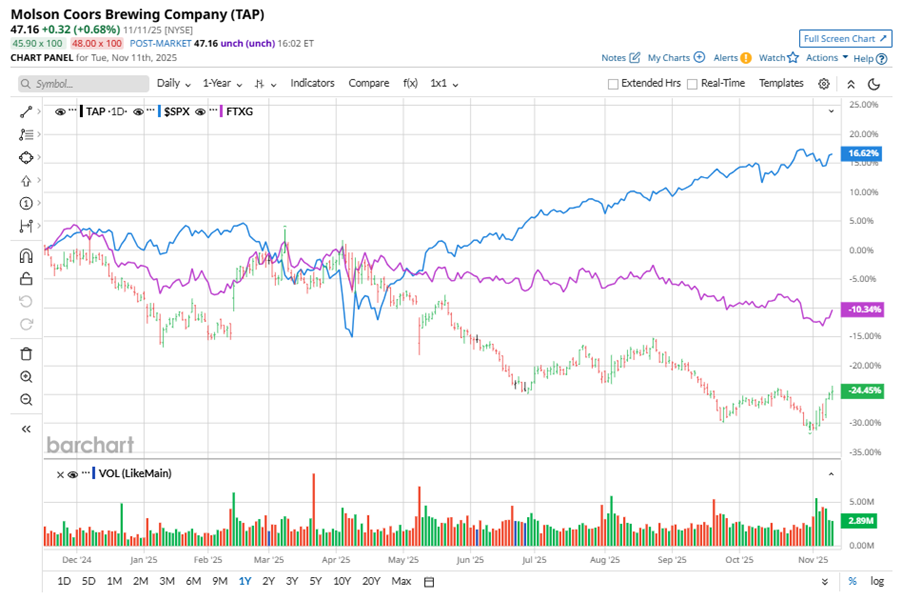

Shares of this brewing giant have underperformed the broader market considerably over the past year. TAP has declined 22.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.1%. In 2025, TAP stock is down 17.7%, while SPX is up 16.4% on a YTD basis.

Narrowing the focus, TAP has also lagged behind the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has declined 12.2% over the past year. Moreover, the ETF’s 7.9% dip on a YTD basis outshines the stock’s double-digit losses over the same time frame.

On Nov. 4, TAP shares closed up more than 1% after reporting its Q3 results. Its adjusted EPS of $1.67 missed Wall Street expectations of $1.72. The company’s revenue was $2.97 billion, falling short of Wall Street forecasts of $3.02 billion.

For the current fiscal year, ending in December, analysts expect TAP’s EPS to decline 9.6% to $5.39 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

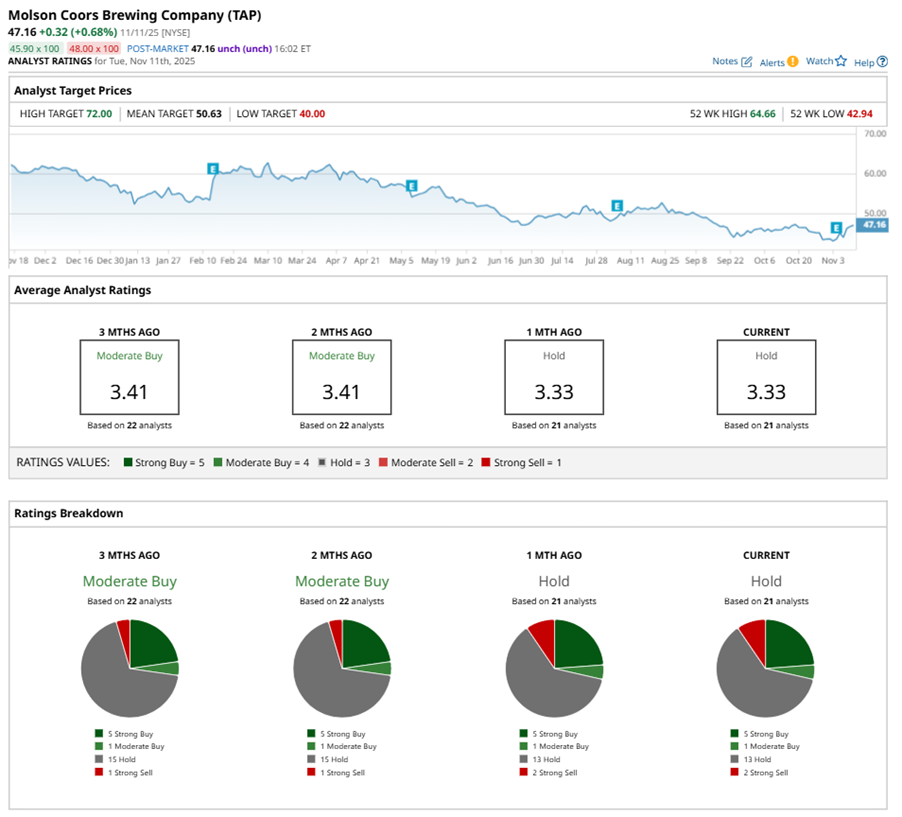

Among the 21 analysts covering TAP stock, the consensus is a “Hold.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and two “Strong Sells.”

This configuration is more bearish than two months ago, with a “Moderate Buy” rating overall, consisting of one analyst suggesting a “Strong Sell.”

On Nov. 4, The Goldman Sachs Group, Inc. (GS) analyst Bonnie Herzog maintained a “Buy” rating on TAP and set a price target of $54, implying a potential upside of 14.5% from current levels.

The mean price target of $50.63 represents a 7.4% premium to TAP’s current price levels. The Street-high price target of $72 suggests a notable upside potential of 52.7%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?