With a market cap of around $20 billion, Darden Restaurants, Inc. (DRI) is one of the largest full-service dining companies in the U.S. and Canada, operating over 1,700 restaurants across multiple brands. Its portfolio includes well-known names such as Olive Garden, LongHorn Steakhouse, The Capital Grille, and Cheddar’s Scratch Kitchen, offering a diverse range of dining experiences.

Shares of the Olive Garden parent have underperformed the broader market over the past 52 weeks. DRI stock has risen 5.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. In addition, shares of DRI are down 5.9% on a YTD basis, compared to SPX’s 16.5% gain.

Focusing more closely, the Orlando, Florida-based company has also lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 9.9% return over the past 52 weeks.

Shares of Darden Restaurants tumbled 7.7% on Sept. 18 after the company reported Q1 2026 adjusted EPS of $1.97, missing Wall Street estimates. Despite quarterly sales of $3.04 billion meeting forecasts, operating costs surged 8.8% to $2.71 billion, driven by higher ingredient and marketing expenses. Additionally, while management raised its annual sales growth outlook to 7.5% - 8.5%, the midpoint of the range fell slightly below analysts’ average expectation, dampening investor sentiment.

For the fiscal year ending in May 2026, analysts expect DRI’s adjusted EPS to grow 11.1% year-over-year to $10.61. The company's earnings surprise history is mixed. It topped the consensus estimates in one of the last four quarters while missing on three other occasions.

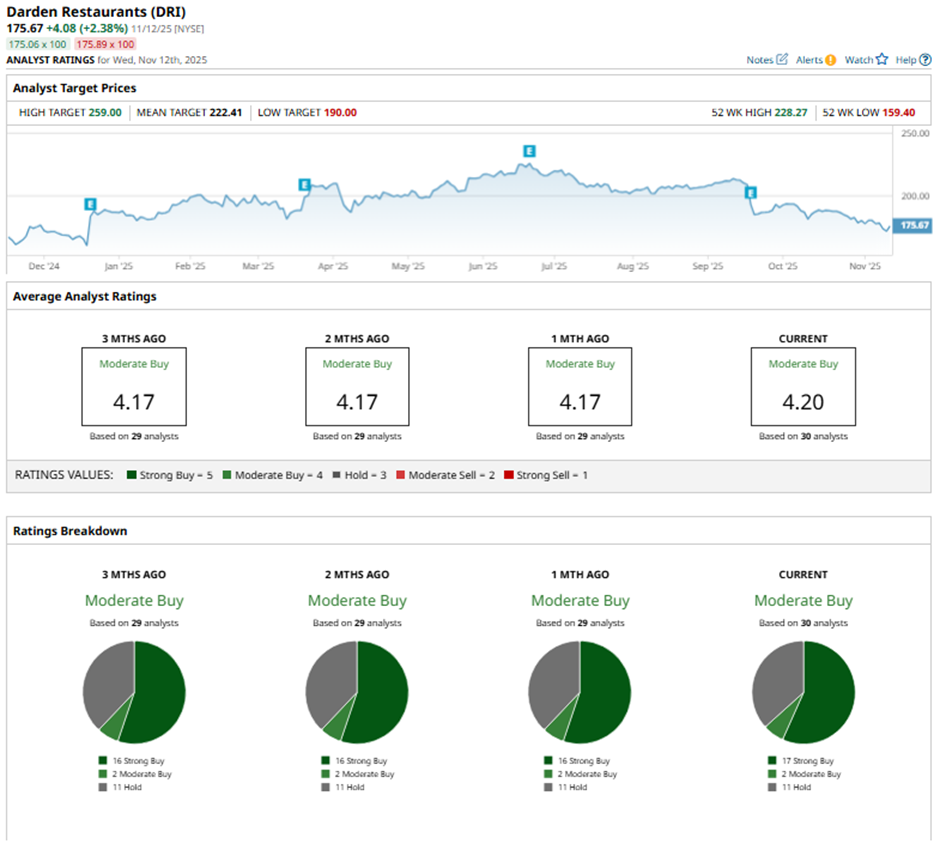

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buy,” and 11 “Holds.”

This configuration is slightly more bullish than three months ago, with 16 “Strong Buy” ratings on the stock.

On Sept. 19, BMO Capital lowered Darden’s price target to $205 and maintained a “Market Perform” rating.

The mean price target of $222.41 represents a 26.6% premium to DRI’s current price levels. The Street-high price target of $259 suggests a 47.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?