Most options traders don’t fail because they’re wrong on direction. They fail because they’re trading blind.

In a recent video explainer, options strategist Rick Orford explained why so many traders struggle to find a consistent way to win in the markets — and it has very little to do with bad stock picks. The real issue is that most traders ignore the mechanics behind option pricing: Greeks and volatility.

These aren’t advanced concepts reserved for hedge funds. They’re practical tools that explain why an option moves, when it’s likely to work, and when the odds are stacked against you.

The Greeks: The Missing Layer Most Traders Skip

Every option price moves for a reason. The Greeks quantify the many moving pieces behind that reason.

Delta is often introduced as a measure of how much an option price moves when the underlying stock moves $1 — but Rick highlights a more important insight. Delta also acts as a rough measure of an option’s probability of finishing in the money.

Specifically, a higher delta generally means a higher chance the option finishes in the money. Higher delta also translates to higher options premiums, but it’s often the case that speculative traders opt for cheap, low-delta calls… and then slowly bleed capital while probability works against them all the way up until expiration.

Theta, or time decay, is another silent killer for options buyers. Every day that passes results in the loss of time value, which erodes at a nonlinear pace that accelerates as expiration draws closer. If the stock doesn’t move fast enough to offset the ongoing loss of time value, the option’s premium will be drained even if your directional price thesis is ultimately right.

Vega completes the picture. It measures how sensitive an option is to volatility. When volatility expands, option prices inflate. When it collapses — such as after earnings — premiums deflate, often brutally. Many traders learn this lesson the hard way without ever knowing the name of the force working against them.

Together, these three Greeks don’t predict direction. They define probabilities and risk — and that’s exactly what separates gambling from trading.

Volatility: Where the Real Edge Lives

Rick makes an important point: volatility isn’t about direction. It’s about magnitude and expectation.

Implied volatility (IV) tells you how much the options market expects a stock to move in the future. Historical volatility (HV) tells you how much it actually moved in the past. When you compare the two, you gain context.

This is where metrics like IV Rank and IV Percentile become powerful. IV Rank shows where current volatility levels stack up relative to the past year. IV Percentile tells you how often volatility has been lower than it is today. When both are elevated, option premiums are expensive. When they’re depressed, option premiums are cheap.

Rick also highlights Implied Volatility vs. Realized Volatility (IV/HV) — a simple but underused ratio. When implied volatility is far above realized volatility, options probabilities tend to favor sellers. When it’s below, buyers often gain the edge. This single comparison can dramatically change how you structure trades.

How Barchart Turns Knowledge Into Trade Execution

Understanding these concepts is one thing; applying them consistently is another. This is where Barchart separates itself from generic charting tools.

Inside Barchart’s Options Screeners, traders can:

- Instantly view Greeks for any strategy

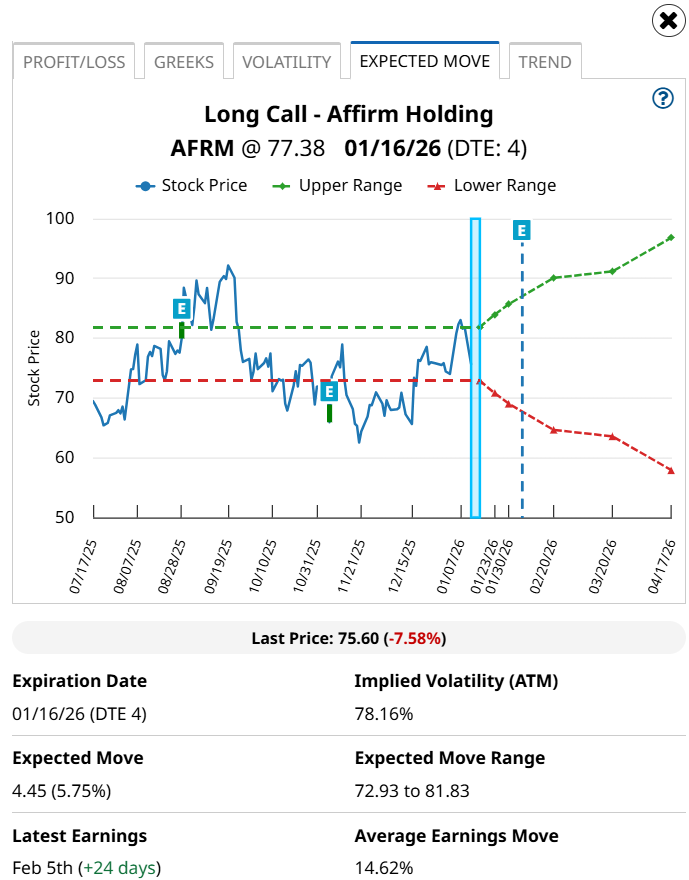

- Analyze Expected Move to frame realistic profit and risk zones

- Compare IV, IV Rank, IV Percentile, and IV vs. HV without manual calculations

- Stress-test trades using Profit & Loss charts before risking capital

Instead of guessing whether a trade “feels right,” traders can measure whether the conditions actually support it. That’s a fundamental shift — and it’s why professionals rely on data, not opinions.

Why Discipline Beats Prediction Every Time

Rick closes with a truth most traders resist: There is always someone on the other side of your trade with the opposite thesis.

Your edge doesn’t come from being right more often than everyone else. It comes from preparation, structure, and emotional control. Markets are uncontrollable. Your process is not.

The traders who survive long-term don’t chase luck. They stack probabilities, manage exposure, and stay consistent, even when the market tests them.

The tools exist. The education exists. The difference is whether you use them.

Because trading isn’t about guessing what happens next. It’s about being prepared when it does.

Watch this quick clip on Greeks & Volatility:

👉 Explore Options Screeners & the Options Learning Center

👉 Stream Rick Orford’s full video on YouTube

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart