Over the past six months, Marriott has been a great trade, beating the S&P 500 by 7.8%. Its stock price has climbed to $284.63, representing a healthy 17.5% increase. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Marriott, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are two reasons why MAR doesn't excite us and a stock we'd rather own.

Why Is Marriott Not Exciting?

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

1. Long-Term Revenue Growth Disappoints

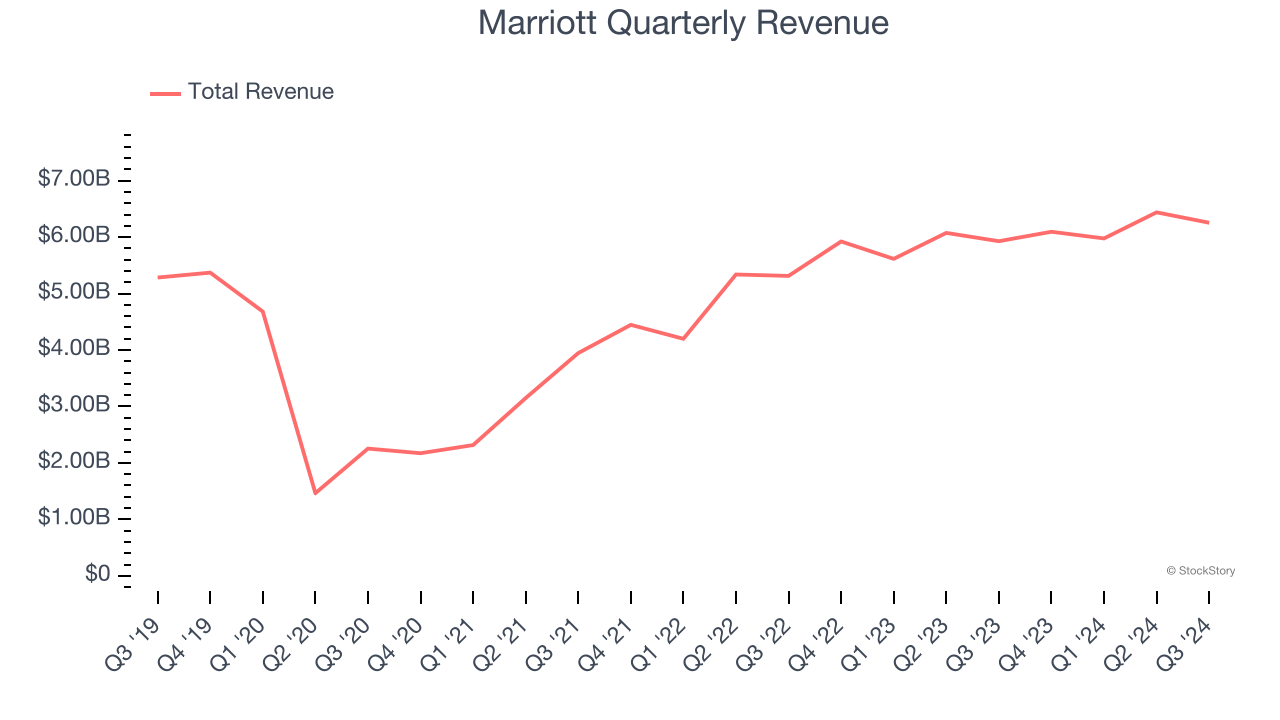

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Marriott grew its sales at a sluggish 3.5% compounded annual growth rate. This was below our standard for the consumer discretionary sector.

2. Weak RevPAR Growth Points to Soft Demand

We can better understand Travel and Vacation Providers companies by analyzing their RevPAR, or revenue per available room. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Marriott’s demand characteristics.

Marriott’s RevPAR came in at $131.72 in the latest quarter, and over the last two years, its year-on-year growth averaged 10.8%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

Final Judgment

Marriott isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 28.1× forward price-to-earnings (or $284.63 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Would Buy Instead of Marriott

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.