United Airlines has been on fire lately. In the past six months alone, the company’s stock price has rocketed 43.8%, reaching $72.21 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in United Airlines, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why there are better opportunities than UAL and a stock we'd rather own.

Why Do We Think United Airlines Will Underperform?

Founded in 1926, United Airlines Holdings (NASDAQ:UAL) operates a global airline network, providing passenger and cargo air transportation services across domestic and international routes.

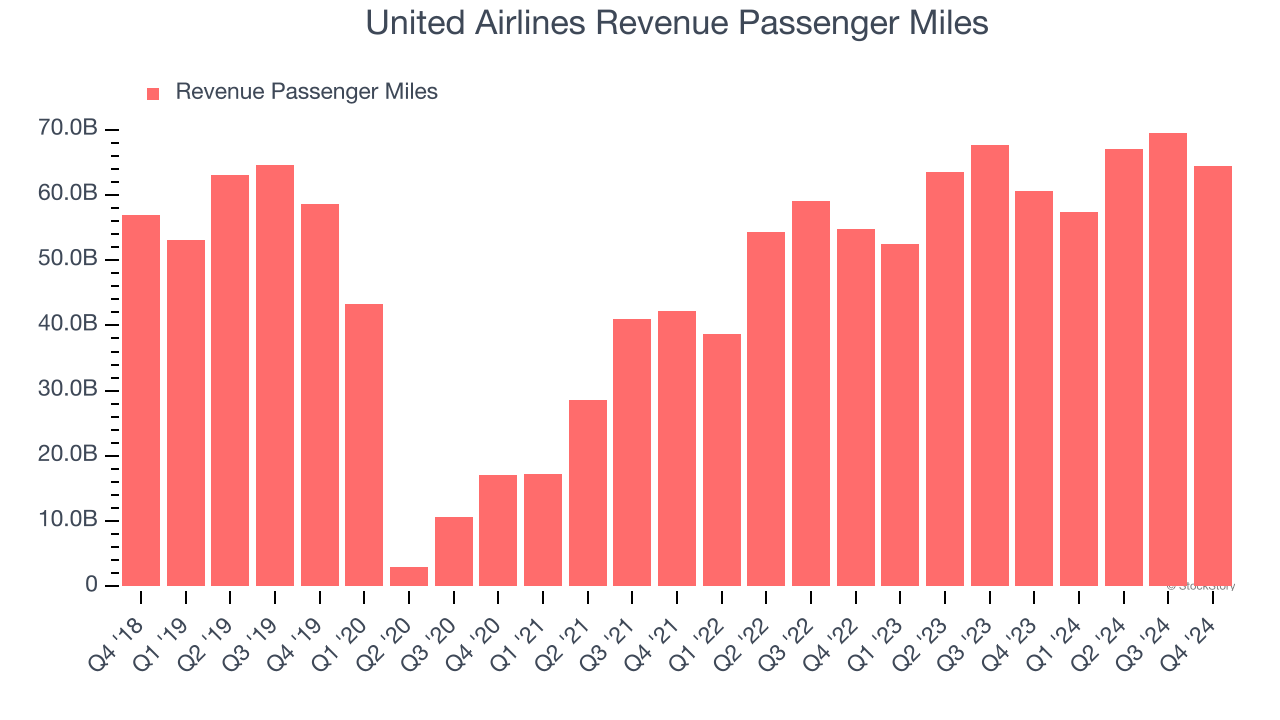

1. Weak Growth in Revenue Passenger Miles Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like United Airlines, our preferred volume metric is revenue passenger miles). While both are important, the latter is the most critical to analyze because prices have a ceiling.

United Airlines’s revenue passenger miles came in at 64.46 billion in the latest quarter, and over the last two years, averaged 12.8% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

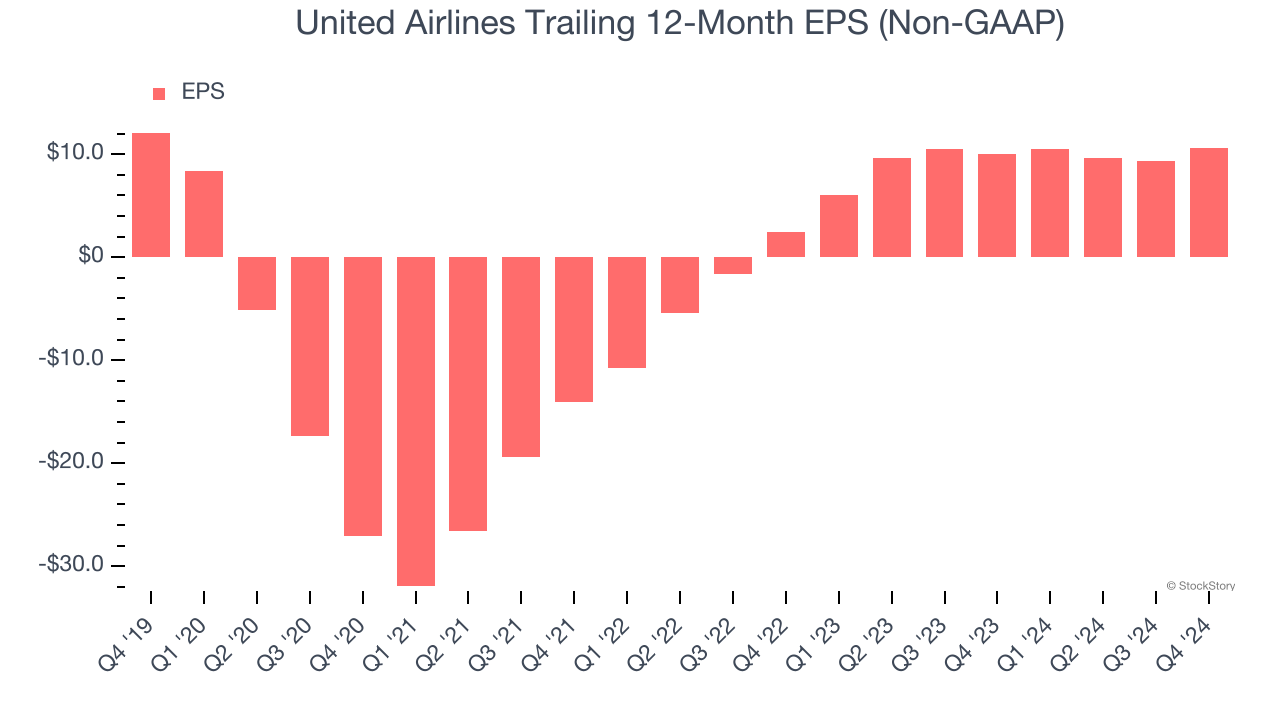

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for United Airlines, its EPS declined by 2.6% annually over the last five years while its revenue grew by 5.7%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

United Airlines historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.9%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

United Airlines doesn’t pass our quality test. Following the recent surge, the stock trades at 5.7× forward price-to-earnings (or $72.21 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Like More Than United Airlines

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.