USA Rare Earth, Inc. - Common Stock (USAR)

17.74

+0.00 (0.00%)

NASDAQ · Last Trade: Jan 13th, 6:51 AM EST

Detailed Quote

| Previous Close | 17.74 |

|---|---|

| Open | - |

| Bid | 18.08 |

| Ask | 18.15 |

| Day's Range | N/A - N/A |

| 52 Week Range | 5.560 - 43.98 |

| Volume | 37,709 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 9,761,126 |

Chart

News & Press Releases

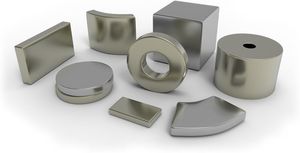

The rare earth mining-to-magnet company is headed for a big year.

Via The Motley Fool · January 12, 2026

Here's Why USA Rare Earth Stock Surged, Again, Todayfool.com

Is it time to buy the rare-earth stock based on recent events in Venezuela and China?

Via The Motley Fool · January 6, 2026

Did a huge opportunity just open up for USA Rare Earth in Venezuela?

Via The Motley Fool · January 5, 2026

As the first trading week of 2026 draws to a close, the domestic rare earth sector has sent a clear signal to global markets: the race for mineral independence is no longer a theoretical exercise, but a high-stakes industrial reality. On January 2, 2026, shares of USA Rare Earth (NASDAQ:

Via MarketMinute · January 5, 2026

Recent geopolitical events are creating anticipation of a benefit for this rare-earth company.

Via The Motley Fool · January 5, 2026

This stock has considerable potential, but also carries significant risks.

Via The Motley Fool · December 29, 2025

USA Rare Earth has been on a roller-coaster ride in 2025, which is a warning sign that investors need to tread with caution.

Via The Motley Fool · December 25, 2025

USA Rare Earth could be shaping up for a game-changing year in 2026.

Via The Motley Fool · December 24, 2025

Here's Why USA Rare Earth Stock Slumped This Weekfool.com

The rare earth company's stock is subject to ongoing speculation over potential support and investment from the Trump administration.

Via The Motley Fool · December 19, 2025

The company continues to mitigate risks in its operations and is positioning itself for future growth.

Via The Motley Fool · December 18, 2025

The company had no news to report. So what's spooking investors?

Via The Motley Fool · December 15, 2025

Houston, USA – December 11, 2025 – In a landmark move poised to reshape the global critical minerals landscape, Argus Media today launched the world's first suite of seven delivered US rare earth oxide prices. This pivotal expansion of its rare earth pricing services into the US market introduces unprecedented transparency to

Via MarketMinute · December 11, 2025

STILLWATER, Okla., Dec. 10, 2025 (GLOBE NEWSWIRE) -- USA Rare Earth, Inc. (Nasdaq: USAR) (USAR or the Company) today announced a significant acceleration of the commercialization timeline for its Round Top heavy rare earth deposit in Texas. The Company now plans to begin commercial production in late 2028, two years earlier than previously anticipated. Round Top is the United States’ richest known deposit of heavy rare earth elements, gallium, and beryllium, and is a cornerstone of USAR’s integrated mine-to-magnet value chain. That value chain also includes a 310,000 sq ft. magnet manufacturing facility in Stillwater, Oklahoma, which is expected to be the largest metal-and-alloy-making and strip-casting capability outside of China, and a processing and separation laboratory in Wheat Ridge, Colorado.

By USA Rare Earth, Inc. · Via GlobeNewswire · December 10, 2025

The company has delivered some good news lately that will please long-term investors.

Via The Motley Fool · December 7, 2025

This company aims to build a vertically integrated business as the U.S. shifts its focus to domestic suppliers of crucial minerals.

Via The Motley Fool · December 5, 2025

It was a relatively quiet day on Wall Street, but a few stocks made big moves.

Via The Motley Fool · December 4, 2025

Valuing USA Rare Earth stock is about to get much easier.

Via The Motley Fool · December 4, 2025

LCM will supply Compass Diversified’s unit Arnold with ex-China rare-earth metals and alloys for advanced permanent magnet production

Via Stocktwits · December 4, 2025

STILLWATER, Okla., Dec. 04, 2025 (GLOBE NEWSWIRE) -- USA Rare Earth, Inc. (Nasdaq: USAR) (USAR or the Company) today announced that its subsidiary, Less Common Metals (LCM), signed a supply agreement with Solvay and Arnold Magnetic Technologies Corporation (Arnold), a subsidiary of Compass Diversified (NYSE: CODI).

By USA Rare Earth, Inc. · Via GlobeNewswire · December 4, 2025

The initiative will support projects that recover and refine rare earth elements from unconventional sources, such as mine tailings, e-waste, and other waste materials.

Via Stocktwits · December 2, 2025

The stock jumped nearly 24% in extended trading after rising 7% in the regular trading session.

Via Stocktwits · November 27, 2025

STILLWATER, Okla., Nov. 26, 2025 (GLOBE NEWSWIRE) -- USA Rare Earth, Inc. (Nasdaq: USAR) (USAR or the Company), today announced that it has been included on the preliminary list for addition to the Russell 2000® Index as published in the FTSE Russell Preliminary List of IPO Additions and is expected to become effective December 22, 2025. Final inclusion is subject to FTSE Russell's standard review process.

By USA Rare Earth, Inc. · Via GlobeNewswire · November 26, 2025

The company just had a major derisking event that nobody is talking about.

Via The Motley Fool · November 26, 2025

STILLWATER, Okla., Nov. 20, 2025 (GLOBE NEWSWIRE) -- USA Rare Earth, Inc. (Nasdaq: USAR) (USAR or the Company), today announced that its wholly owned subsidiary, Less Common Metals (LCM), has established a strategic partnership with Solvay, a multinational chemical company, to supply rare earth metals to Permag, a leader in high-precision magnets and magnetic assemblies.

By USA Rare Earth, Inc. · Via GlobeNewswire · November 20, 2025