Shell plc (SHEL)

73.18

+0.00 (0.00%)

NYSE · Last Trade: Jan 14th, 4:33 AM EST

Date: January 13, 2026 Introduction As of early 2026, Exxon Mobil Corporation (NYSE: XOM) finds itself in an extraordinary position: a financial titan at the peak of its operational powers, yet locked in a high-stakes geopolitical game of chicken with the United States executive branch. While the company’s balance sheet has never looked stronger following [...]

Via PredictStreet · January 13, 2026

In a transformative move for the Southern Cone’s energy landscape, Chile’s state-owned oil company, Empresa Nacional del Petróleo (ENAP), announced on January 12, 2026, that it has officially adopted Argus Media’s price assessments for its crude oil imports from Argentina. This strategic pivot marks the largest commercial

Via MarketMinute · January 12, 2026

The global energy market experienced a sharp recalibration on January 12, 2026, as crude oil prices retreated from one-month highs. The pivot followed official statements from the Iranian government claiming that widespread civil unrest, which had gripped the nation for over two weeks, was now "under total control." This cooling

Via MarketMinute · January 12, 2026

Only a handful of oil companies benefited. Here's why, and why it may not last.

Via The Motley Fool · January 8, 2026

As of January 8, 2026, the landscape of high-performance computing (HPC) has undergone a tectonic shift, and few companies embody this transformation more than Applied Digital (Nasdaq: APLD). Once a niche player in the cryptocurrency hosting space, Applied Digital has successfully repositioned itself as a critical backbone for the generative AI revolution. The company is [...]

Via PredictStreet · January 8, 2026

As of January 8, 2026, Chevron Corporation (NYSE: CVX) finds itself at the center of one of the most significant geopolitical shifts in the energy sector in decades. While the global oil market grapples with a sustained crude price retreat—with Brent falling below $60 per barrel—Chevron has emerged as the primary beneficiary of a historic [...]

Via PredictStreet · January 8, 2026

As of early January 2026, the global liquefied natural gas (LNG) market has reached a critical inflection point, marking the end of the hyper-volatile era that defined the first half of the decade. The once-gaping price chasm between United States domestic gas and international benchmarks in Europe and Asia has

Via MarketMinute · January 8, 2026

In a move that signals the definitive transformation of European natural gas from a regional utility into a global commodity, the Intercontinental Exchange (NYSE: ICE) officially announced today, January 8, 2026, that it will extend the trading hours for its Dutch Title Transfer Facility (TTF) benchmark to 22 hours a

Via MarketMinute · January 8, 2026

Shell PLC (NYSE: SHEL) updated its Q4 2025 outlook, tightening guidance for production in integrated gas and upstream segments.

Via Benzinga · January 8, 2026

As of January 7, 2026, Chevron Corporation (NYSE: CVX) finds itself at the epicenter of one of the most significant geopolitical shifts in the energy sector this century. Long regarded as the "last man standing" in Venezuela, Chevron’s patient, decades-long strategy of maintaining a presence in the sanctions-hit nation has transitioned from a risky survival [...]

Via PredictStreet · January 7, 2026

Nigeria has reported a significant milestone in its energy sector recovery, with the state-owned Nigerian National Petroleum Company Limited (NNPC) announcing that total crude oil and condensate production reached 1.6 million barrels per day (bpd) in November 2025. This production surge marks a critical turning point for Africa’s

Via MarketMinute · January 2, 2026

As of January 1, 2026, the global energy landscape is reeling from a New Year’s Day escalation in rhetoric from the Trump administration, which has effectively weaponized federal sanctions to force a resolution to the protracted Ukrainian conflict. Following a New Year’s Eve incident involving alleged drone activity

Via MarketMinute · January 1, 2026

As the clock struck midnight on December 31, 2025, the global energy sector closed the books on its most turbulent year in half a decade. Crude oil benchmarks recorded their steepest annual decline since the 2020 pandemic, with prices tumbling nearly 20% over the last twelve months. This sharp correction,

Via MarketMinute · January 1, 2026

The year 2025 has drawn to a close, leaving the global energy sector in a state of "uneasy equilibrium" after twelve months defined by a fierce tug-of-war between geopolitical friction and a bearish macroeconomic landscape. While the industry grappled with significant crude oil price declines—the largest since the 2020

Via MarketMinute · December 31, 2025

As 2025 draws to a close, the global energy landscape remains defined by a volatile cocktail of geopolitical brinkmanship and shifting trade alliances. From the "Trump effect" accelerating U.S. LNG exports to the precarious status of cross-border gas deals in South America, the market has spent much of the

Via MarketMinute · December 31, 2025

As 2025 draws to a close, the global crude oil market is locked in a high-stakes "tug-of-war" between a looming supply surplus and a persistent geopolitical risk premium. While the broader trend for the year has been one of decline—with benchmark prices falling approximately 20% since January—the final

Via MarketMinute · December 31, 2025

As the final trading days of 2025 unfold, the global commodities landscape is defined by a sharp contrast between a stabilizing energy sector and a record-breaking rally in industrial metals. Brent crude oil, which spent much of the fourth quarter under pressure, has staged a modest recovery to trade just

Via MarketMinute · December 29, 2025

Brent crude oil futures climbed to $62.4 per barrel on Friday, December 26, 2025, marking a sharp reversal from mid-month lows and securing a significant weekly gain. This rally comes as a series of geopolitical flashpoints—ranging from a U.S. naval blockade in the Caribbean to drone strikes

Via MarketMinute · December 26, 2025

ADEN/RIYADH — As the world observes the Christmas holiday, the geopolitical landscape of the Arabian Peninsula is undergoing its most violent transformation in years. A sweeping military offensive launched in early December by the Southern Transitional Council (STC)—Yemen’s primary separatist movement—has effectively dismantled the Saudi-backed unity government,

Via MarketMinute · December 25, 2025

As the global energy market closes out 2025, the OPEC+ alliance has executed a high-stakes tactical maneuver designed to prevent a total price collapse in the face of a looming global supply glut. Following a modest production increase of 137,000 barrels per day (bpd) in December 2025, the cartel

Via MarketMinute · December 25, 2025

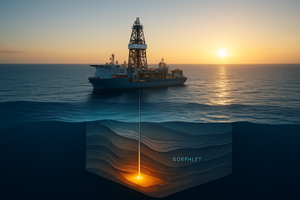

In a landmark announcement on December 22, 2025, energy giants Shell and INEOS Energy revealed a significant oil discovery at the Nashville exploration well, situated in the deepwater Norphlet play of the U.S. Gulf of Mexico—a region now increasingly referred to by industry and government officials as the

Via MarketMinute · December 22, 2025

Energy Transfer continues to face roadblocks with Lake Charles LNG.

Via The Motley Fool · December 21, 2025

As the global energy landscape undergoes a seismic shift, the Austrian energy giant OMV AG (VIE:OMV) is executing one of the most ambitious transformations in its 70-year history. By late 2025, the company has moved decisively to pivot away from its traditional oil and gas roots toward a future

Via MarketMinute · December 19, 2025

As the final weeks of 2025 unfold, the global energy market is locked in a high-stakes tug-of-war between mathematical certainty and geopolitical reality. On paper, the outlook for 2026 is nothing short of grim: a "tsunami" of crude oil is projected to flood the market, potentially driving prices to levels

Via MarketMinute · December 19, 2025

The global energy landscape faced a reckoning on December 18, 2025, as a landmark inflation report collided with a burgeoning oversupply in the crude oil markets. While the broader S&P 500 and Nasdaq rallied on news that price pressures are finally returning to the Federal Reserve’s comfort zone,

Via MarketMinute · December 18, 2025